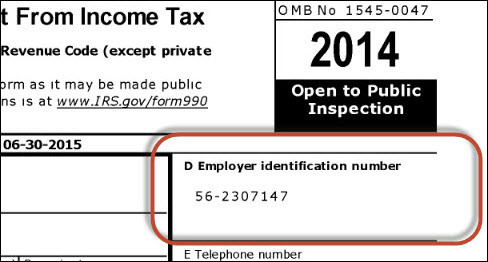

When you run a business, there are many deadlines to keep track of. You might need to remember when to pay your bills, How to get LLC, or when to renew your EIN. One thing you don’t have to remember is that your EIN will never have to be renewed.

Once your company has Applied for EIN, you never have to renew. Your EIN number is permanent and will never change. It is uniquely assigned to your business only and cannot be altered, so therefore there is no need to renew. In fact, if the EIN number changed or needed renewing each year, it would cause chaos for your company, other companies, and the IRS.

However, there are certain circumstances in which a new EIN might need be assigned, although this would not be considered a renewal. You would need a new EIN if the ownership of your company changed in any way, or if the structure changed. Such as going from an LLC to a sole proprietorship, etc.

If you ever have any questions regarding your EIN number, contact GovDocFiling. Our team of professionals is waiting to help you in any way we can. We understand that there can be a lot of questions regarding applying for an EIN and the questions will continue to come once you have obtained the number and are using it for your business purposes.

We can also help you if you need to change the structure of your business and therefore obtain a new EIN number. Our application process is quick and easy to use, and we are here to help walk you through the process along the way. You shouldn’t have to spend time on tasks such as these when you have a business to run. Let us take care of it for you!